Updated January 29, 2024

As a wave of older Americans face the real possibility of needing long term care, the California legislature is considering funding a modest amount of state-provided long-term care (LTC) coverage. There are many questions about what the legislation might include if it is enacted. The nation’s most populous state has taken preliminary steps to explore the possibility of offering a long term care benefit but there is still a long way to go. An actuarial report by the firm of Oliver Wyman, commissioned by the legislature, was released on December 15, 2023 along with updated FAQs. You can find updated links to all related documents below.

This information may help individuals interested in exploring their private LTC insurance options.

Start Here > Presentation: AB567 Actuarial Analysis and Next Steps (Nov 2023) – a high-level summary of the actuarial report.

CA Assembly Bill 567: Oliver Wyman Actuarial Report

View AB567 Task Force Recommendations for Next Steps Dec 2023

View AB567 Task Force Clarifications (Effective Date and Communication Clarification)

KEY POINTS FOR ADVISORS

Important Instructions Regarding Communication About Program Enactment:

- Any agent or insurer communication stating that a public LTC program will be (or is likely to be) enacted on January 1, 2024, or on any other specific date is factually untrue

- Agent or insurer communications can:

– Explain that the Task Force has recommended options for the design of a public LTC program

– Discuss the implications of a potential tax and/or opt-out for a consumer - Agent or insurer communications should be clear that:

– There is no program, tax, or deadline being implemented at this time

– The Legislature would need to take action before a program or tax could be implemented

– All details and deadlines are up to the Legislature or a designated state agency

- Final report was released December 2023. Legislation may be discussed in 2024/2025. The Legislature may or may not choose to proceed with legislation to establish a program.

- Key takeaways of December 2023 Actuarial Report:

- There is no opt-out provision included in Design 1: Supportive LTC Benefits

- Designs 2-5 include a full opt-out provision “for individuals who purchase eligible private insurance before Program effective date.”

- Designs 2-5 also include “Reduced contributions for individuals who purchase eligible private insurance

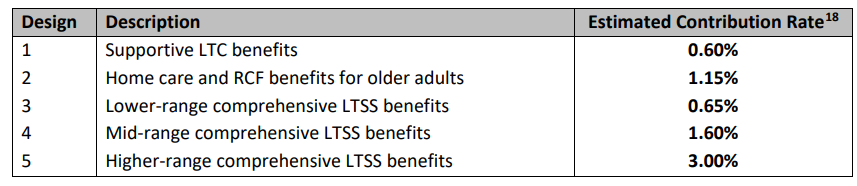

after Program effective date.” - CA Payroll Tax pricing looks very similar to WA Cares Fund for the lowest benefit level at 0.6% of income

- There is a proposed income cap unlike WA at $400,000 of income

- The tax could be as much as 3% of income at the highest plan design

- May be a shared tax cost between employers and employees

Estimated Contribution Rate By Program Design

- It’s prudent to consider private long term care insurance as a way to help manage long term care costs. BuddyIns recommends that agents and specialists have this conversation with clients regardless of any proposed state efforts. Offer a group or individual solution that is either traditional or hybrid with LTC rider could provide more options to Americans who may need long term care.

-

As we experienced with WA, carrier capacity may be limited if the state announces an opt-out provision.

- Do not use fear tactics or misleading statements when speaking to clients. Per the CA Department of Insurance, “Any communication that states that a public LTC program will be enacted on January 1, 2024, or on any other specific date, is untrue and a presumed

knowing violation of the law.”

In this article, we provide insight and make assumptions based on the California Long Term Care Insurance Task Force preliminary recommendations. At BuddyIns, we believe that the state coverage as proposed may help Californians cover some of their long term care costs. However, the amount proposed may leave a tremendous gap in coverage based on the current and projected cost of care.

We’ve outlined some key takeaways from the California Task Force recommendations along with corresponding differences from the Washington law. The recommendations are now undergoing an actuarial review which is scheduled for completion by the end of 2023.

- The proposed CA benefit designs vary from $36,000 of coverage up to $144,000 for the most comprehensive option. In comparison, the cost of care for a 3-year long-term care claim event projected out in 30 years is around $1,000,000. In WA, the amount of coverage was $36,500 with nominal increases.

- We anticipate the California payroll tax to be priced based on how comprehensive the program design is. In WA, the payroll tax is 0.58% of annual wages including income, bonuses, vacation time, and the value of annual stock grants.

- The CA tax may be a level payroll tax split between employer and employee – unlike WA which places the tax burden on the employee.

- Considerations for individuals with (eligible) private insurance:

- Opt-out provision if purchased before the Program’s effective date

- Reduced Program contributions if purchased after the Program’s effective date.

- There are no specifics yet on how the state will define what is eligible as private coverage. In WA, the definition of LTC insurance was broadly defined to include both traditional and hybrid products with LTC riders.

- Regardless of how the exemption is structured, CA employees may want to start the process of purchasing private insurance before any final state announcements are made. This could help avoid the rush for long-term care insurance coverage that we saw in WA.

- IMPORTANT: The state may assess the financial impact of changing the deadline for the purchase of opt-out eligible private insurance policies from the Program effective date to the beginning of the year preceding the Program effective date. (Final Draft Feasibility Report, page 15)

- There are slightly fewer group and individual products and carriers in CA than in WA, mostly because product approvals from the state take longer. However, taking steps to purchase coverage now means there is a robust market of options available, before the expected increase in demand if a law gets enacted.

- There are approximately 16,500,000 employees in CA, more than four times the number in WA. BuddyIns expects a limited capacity of individual and group products with qualifying LTC riders in California.

View the Task Force Next Steps.

START YOUR LONG TERM CARE PLAN NOW

Now is the time to begin the process of obtaining meaningful long-term care insurance (LTCi) coverage. Why? Because you never know when a long term care event might happen.

Another reason to start the process of obtaining coverage is that planning early may result in the best value solution. If you begin planning when you are younger, you get a better overall value assuming your health is good. Waiting could mean that the premium costs are higher, or a health event may make you ineligible for insurance.

A LIFE INSURANCE OR LONG-TERM CARE PRODUCT THAT FITS YOUR NEEDS AND BUDGET

At BuddyIns, we recommend obtaining meaningful coverage rather than just enough to possibly qualify for a state exemption. What does that mean for you? Meaningful coverage provides the insurance benefits that may best cover the risks you believe will impact you. The cost is affordable, and it is a plan that you can financially manage over your lifetime. The most popular solutions in Washington came from not only affordable LTCi-focused coverage but also life insurance coverage with LTC riders. Younger clients who did not have their life insurance plans used the WA payroll tax as an opportunity to protect their families with affordable hybrid policies.

The ideal candidate to purchase long-term care insurance or life insurance is someone who would have pursued coverage regardless of the any payroll tax. They may now decide to buy sooner than they would have because of proposed government programs and the ability to opt-out or supplement the state benefits.

Higher earners with more income and assets to protect may see the best value from purchasing a private plan. If a proposed payroll tax is a percentage of all wages, like in WA, a higher earner could pay more into the payroll tax than they could get in benefits.

For example, a 40-year-old employee is making $200,000 per year and expects her wages to grow 3% per year. If she retires at age 65, she will have put in a projected $42,293 over 25 years. If the lifetime maximum is similar to the Washington State benefit, it will be around $36,500 with nominal increases.

However, one should never purchase a long term care insurance policy solely for the purpose of opting out of a proposed payroll tax. Reach out to a long-term care specialist if you would like to begin the planning process. Even if you are not ready to purchase yet, understanding your options and meeting with an LTCi specialist will allow you to act more quickly later.

>>Learn About Other States Considering a Long Term Care Payroll Tax

LONG-TERM CARE INSURANCE-FOCUSED SOLUTIONS

Traditional Long Term Care Insurance or Life Insurance Hybrids with LTC Extension

Let’s look at some numbers by considering another 40-year-old CA employee. This employee decides he wants to purchase traditional long-term care insurance. He anticipates needing care at age 80. In this scenario, he could obtain a policy with 6 years of protection to provide a total maximum benefit of $1.1 million of tax-free LTC benefits. California has some of the highest costs of care in the country. By adding these benefits he maintains control over his care rather than leaving it to his family to decide on their own.

By using our BuddyIns proprietary software, Benefit Buddy, we created the chart below. It reflects the impact of purchasing long-term care insurance vs. self-funding a long-term care event that begins at age 80.

- Traditional LTC Pie Chart: The “Insurance Multiplier” or the maximum amount of coverage one might receive relative to the premium at age 80. It reflects the total premiums paid versus the total long-term care benefits.

- Self-Funding Pie Chart: Reflects self-funding the total amount of care. Self-funding assumes a person earns a 5% rate of return on their savings and incurs a 20% tax rate if the investment returns result in taxable gains.

Traditional long-term care insurance is not the only option when it comes to long-term care coverage. Some hybrid options provide excellent LTCi coverage, including:

- An extension of benefits feature

- Cash value flexibility

- A death benefit if the long-term care rider is never used

Purchasing a hybrid now offers our employee above the ability to change his mind about the coverage later. That allows him to retain some or all the value of the premiums already paid into the policy.

Don’t worry. You do not have to figure all of this out on your own. A long-term care insurance specialist can help find the product that is a good value for you.

>>Your Guide to Long-Term Care Insurance

LIFE INSURANCE-FOCUSED SOLUTIONS WITH LTCI FEATURES

Permanent Life Insurance with LTC Acceleration or Term Life with Conversion Options

For those who desire life insurance, several popular options on the market also include true LTC riders. These solutions include permanent life insurance like universal or whole life. Both products have unique features and benefits at affordable rates, especially for starter plans.

There are no term life policies with true LTC riders but some strategies allow conversions. That means you can obtain term coverage today, then can convert to a permanent product and add the LTC rider later. This allows you to:

- Maximize your life insurance death benefit with term insurance now

- Maximize the flexibility and cash values with permanent insurance later

You may also do both while retaining the option to receive “living benefits” in the form of an LTC benefit that may qualify for the payroll tax opt-out.

This option might be a great choice if you are younger and have a greater life insurance need.

The deadline for purchasing private coverage is still unclear or even if there will be an opt-out with certainty. If you purchase the coverage you need now, that can be a win regardless of how the law plays out.

START NOW TO OPTIMIZE YOUR CHOICES REGARDLESS OF THE CALIFORNIA PAYROLL TAX

At BuddyIns, we do not recommend purchasing long term care insurance purely to qualify for a possible payroll tax exemption. A private long term care insurance policy can provide peace of mind to anyone interested in having more options in the event that they need extended care. It reduces the strain on other assets and the burden on the family. The great news is that approximately 85% of working employees should be able to obtain coverage. Starting the process sooner rather than later can provide you with the most options and peace of mind. We highly recommend that you begin your process by speaking with a long-term care specialist.

Share:

You Might Also Like

BuddyIns Monitors CA State LTC Payroll Tax Updates

CALABASAS, CA, UNITED STATES, January 4, 2023 /EINPresswire.com/ — On December 15, 2022, the California Long Term Care Insurance Task Force released the results of a Feasibility Report evaluating the viability of a state-funded long-term care insurance benefit and possible long-term care payroll tax to fund the benefit. In 2019, the California State Legislature passed AB 567, […]

Read More >