Washington state is implementing a new .58% payroll tax on all W-2 employees who work in-state. You must purchase your own policy prior to November 1, 2021 to opt out of this payroll tax. Update: Due to the overwhelming demand for LTC insurance in Washington, policies likely will no longer be issued in time to meet the state's November 1, 2021 deadline.

By Marc Glickman, FSA, CLTC©

This article first appeared in CLTC Digest, Spring 2021

This article was drafted based on the information available at the time. Due to the overwhelming demand for LTC insurance in Washington, and products that are medically underwritten, policies likely will no longer be issued in time to meet the state’s November 1, 2021 deadline. You may be able to purchase coverage that is more robust and that may supplement state provided coverage. If you purchased meaningful coverage and want information on how to apply for an exemption to opt out of the WA payroll tax, click here.

If you’re a Washington State resident, everyone is talking about long-term care insurance. Back in 2019, the state passed a law to fund a public long-term care program through a mandatory payroll tax on every W-2 employee. The only exception is to opt out by purchasing private long-term care insurance. Things were relatively quiet until the state amended the law in April 2021to shorten the time available to purchase private LTCi. Now, one must purchase a policy prior to November 1, 2021, to opt out of the payroll tax.

Suddenly, everyone in Washington is rushing to find an LTC insurance agent.

Washington has one of the highest costs for long-term care services in country.1 One of the reasons may be that it also has one of the most generous Medicaid waiver workers across the country; the cost of care has risen much higher in recent years. Last year, due to the effects of COVID, the increases were magnified further. Medicaid programs are strained in states around the country, but especially in Washington.

If you’re not in Washington and think this doesn’t affect you, think again. There are at least five other states discussing the same program and one of the most populous states in the country may be pricing out a payroll tax of its own.

LANDMINES TO AVOID WHILE OPTING OUT

FINDING AN LTCI PRODUCT THAT WORKS

If you’re considering private LTCi for the purpose of opting out of the payroll tax, your first instinct might be to look for a guaranteed issue LTCi plan through your employer and self-enroll for the minimum possible coverage. Not so fast. When this began, there were two simplified issue worksite LTCi options. Even before the law was signed, one of the carriers had already announced they were exiting the market due to unrelated reasons, and the other had already decided to limit the number of enrollments.

What about life insurance with LTC or chronic illness riders? There has been a proliferation of these products that have emerged over the past decade including a few guaranteed issue options for employees. Do these products qualify for opting out? It depends on the Trust Act’s definition of long-term care. At the time of this article, most signs indicate this being the code in RCW 48.83.0202, but recent guidance on the official WA Cares website cited additional definitions related to dedicated long-term care riders (7702B) and then those definitions mysteriously disappeared.

The safest route is probably to purchase either an individually underwritten traditional LTCi plan or a true hybrid product designed primarily for LTC planning. For these products, you will want to find an LTCi specialist who can shop the market for the best value, and more importantly, find a product for which you can health qualify. The good news is that 85% or more of working employees may be able to obtain coverage from one of a dozen different insurance products in the marketplace based on health.

BUYING MINIMUM COVERAGE AND AVOIDING TEMPTATION TO DROP THE POLICY AFTER OPTING OUT

The natural instinct is to try to purchase an insurance policy that costs less than the payroll tax. Unfortunately, you may be hard pressed to find it. Carriers are beginning to limit the capacity of such products or establishing their own minimums. You may also end up with a policy that provides such limited LTC benefits that you are tempted to drop the policy the moment after you receive your opt out approval.

There are several potential risks to the buy-and drop strategy:

- If too many people are dropping policies, Washington may decide to recertify coverage at a later date or when the client changes employers. The WA Cares Fund administrators are given latitude in the law to audit coverage, impose minimums, or even ask on the opt-out form: “Do you intend to keep your coverage?”

- You may drop your policy and soon thereafter need long-term care services. It is not as uncommon as it sounds for clients to require care after being in a severe car accident, suffering illness (COVID), or a disease like cancer.

- Agents may be unwilling to offer you a solution. High policy lapse rates are a red flag for insurance companies that may result in an agent losing their ability to sell the insurance company’s products or being accused of churning their clients. LTCi specialists licensed in WA will be in high demand until November.

Your best bet for your plan, and also from the perspective of state regulators, carriers, and agents alike is to buy at least minimum meaningful coverage. You’ll even want to consider more robust coverage when the insurance value is particularly good. It turns out using LTCi the way that it is intended may be your best strategy.

DOES IT MAKE SENSE TO OPT OUT?

The ideal employee for opting out of the WA Cares Fund is actually the same person who might want to consider LTCi in the first place for planning purposes.

Higher earners with more income and assets to protect are going to see the best value from opting out because the payroll tax is uncapped. The tax also includes all wages including income, bonuses, vacation time, and the value of annual stock grants. It is quite possible for a higher earner to pay more into the payroll tax than they could even get out of the WA Cares Fund.

The math is pretty straightforward. Take your annual wages and multiply by 0.58%. Consider how much your wages will grow each year in the future until retirement. Add together each year to get your total payroll tax.

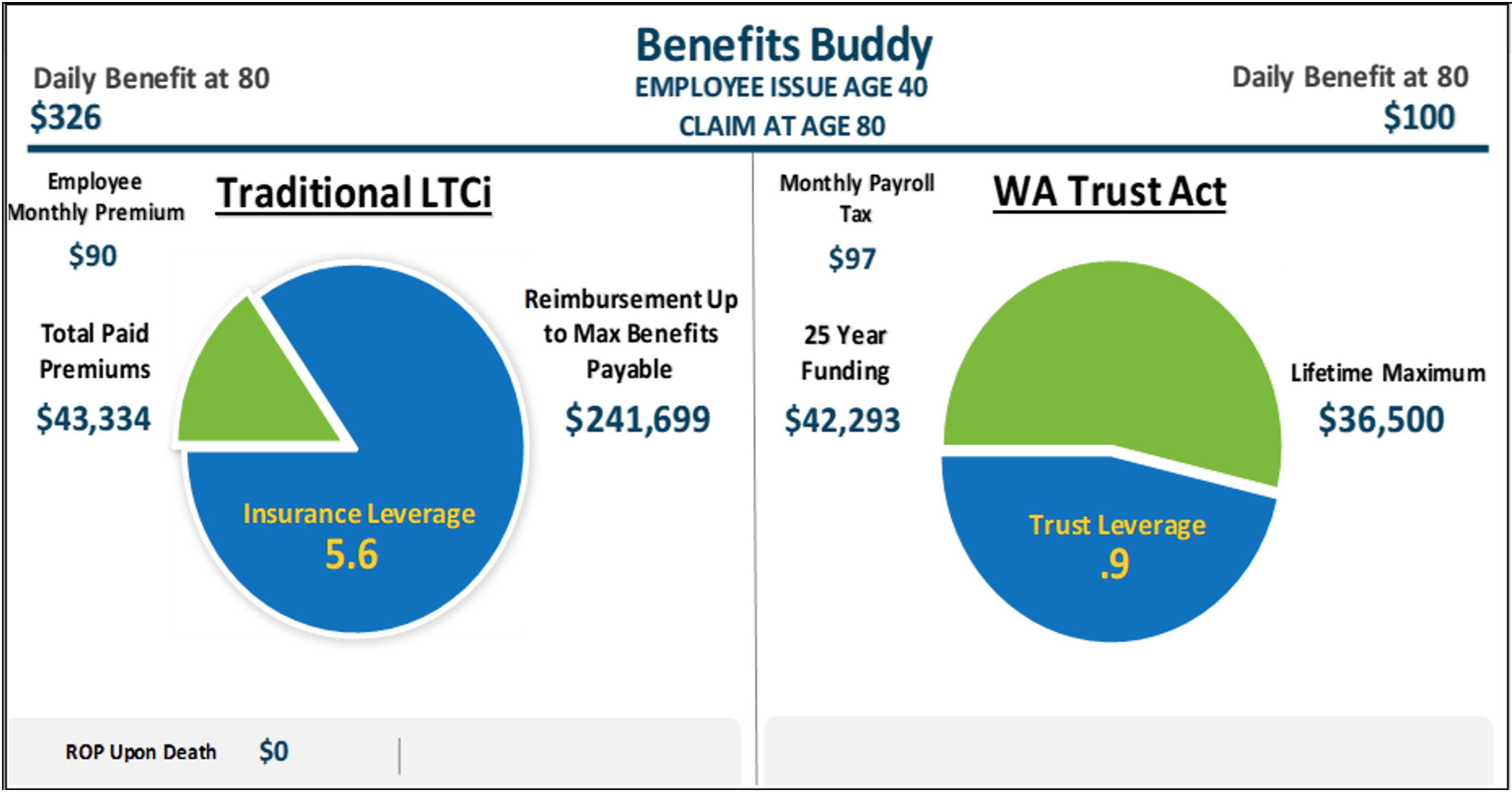

For example, a 40-year-old employee is making $200,000 per year and expects her wages to grow 3% per year. If she retires at age 65, she will have put in a projected $42,293 over 25 years. A lifetime maximum of only $36,500 with nominal increases can be received from the WA Cares Fund.

Other individuals who may want to consider opting out:

Those that will not likely pay into the payroll tax for at least 10 years without a break of five consecutive years (unless the individual needs care and is applying for benefits, in which case it is three out of the last six years.) Many individuals will not meet this vesting criteria and may be better off considering private insurance.

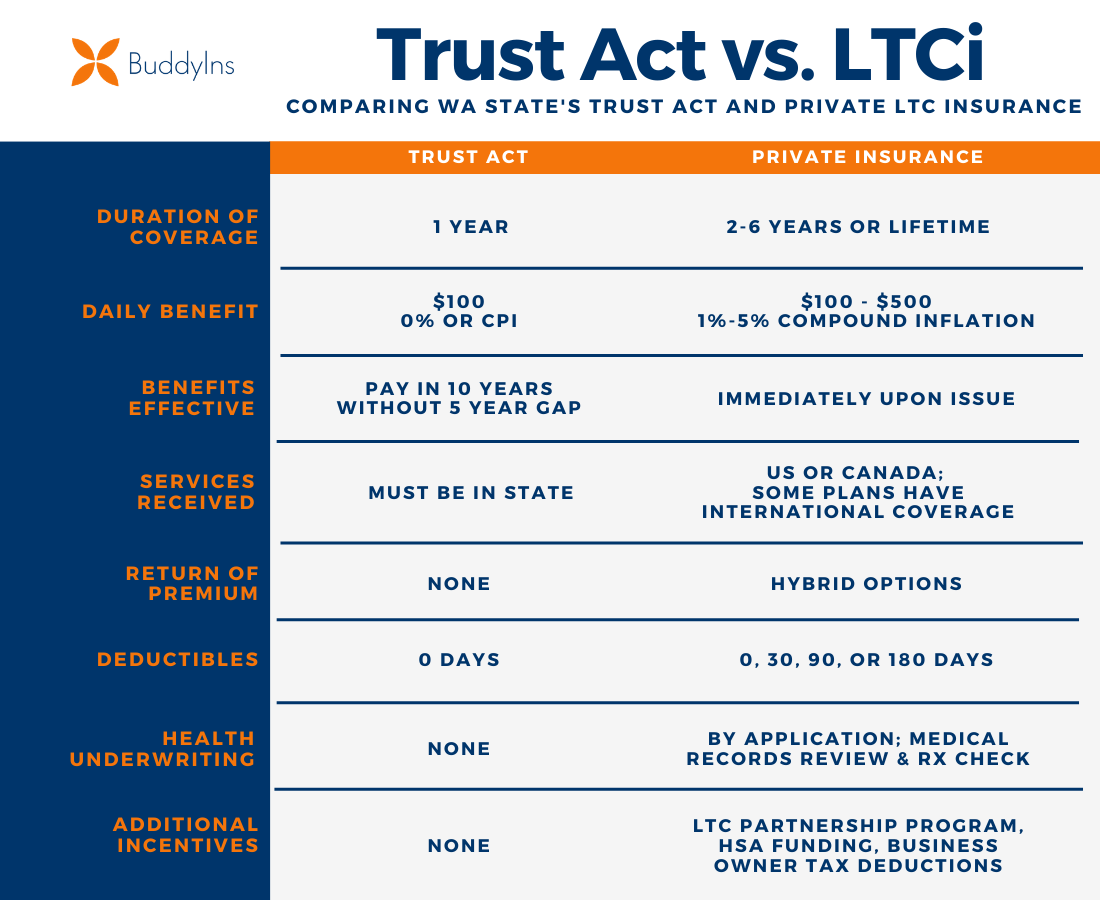

The WA Cares Fund only provides benefits to residents of Washington. So, those who plan to move out of state for five or more years, may forfeit payroll tax premiums and benefits. This would cost between $40 to $160 per month depending on age and gender, but total benefits compounded at 3% inflation may far exceed the Trust Act benefits at older ages when you are most likely to need care.

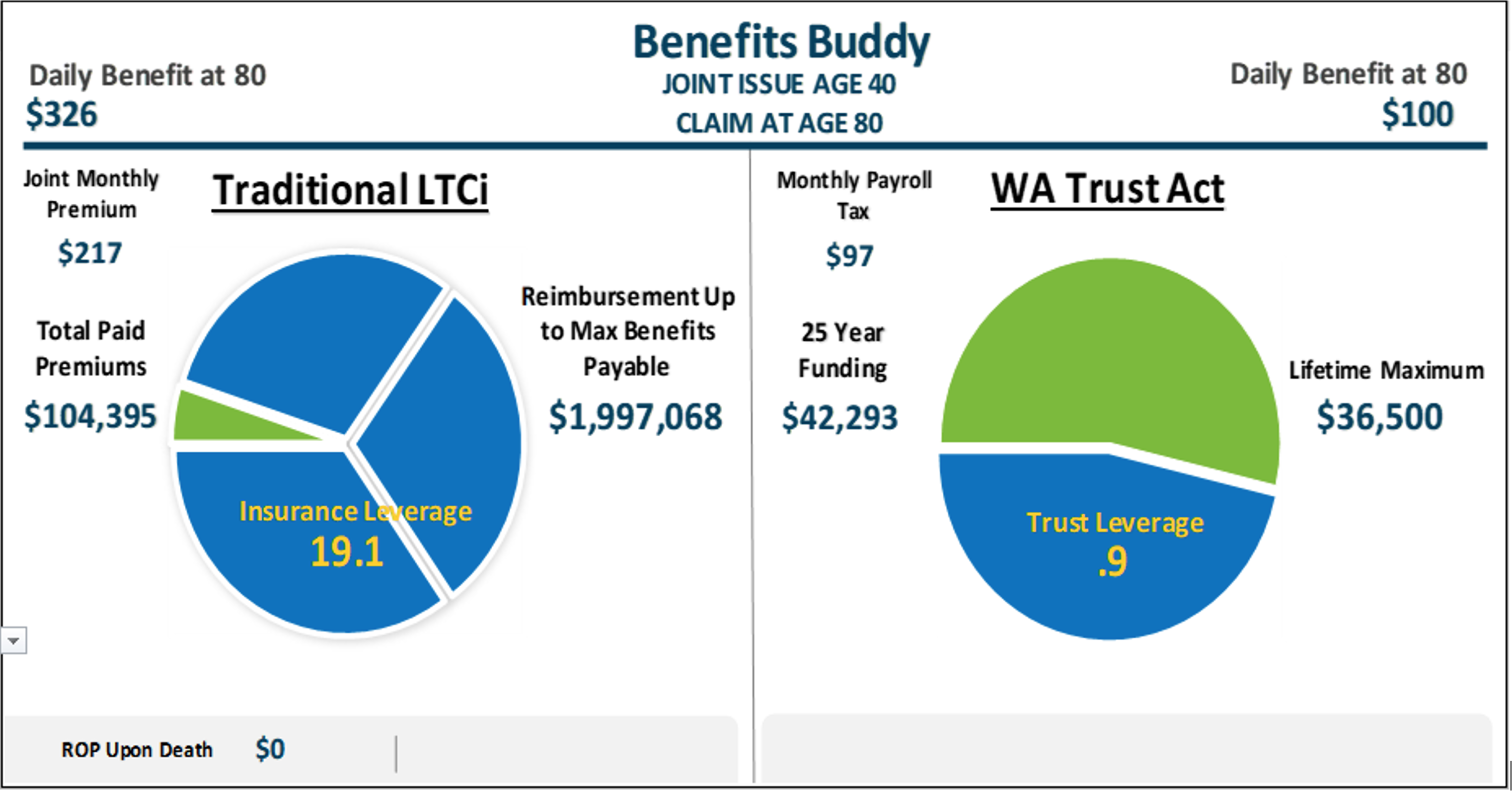

- Buying robust coverage with longer benefit periods can increase the insurance leverage.

- Including your spouse for additional discounts, especially if your spouse is also a W-2 employee.

- Purchasing dedicated long term care riders or traditional plans with return of premium options that have the flexibility to cash out the policy and receive back 80-100% of the premiums paid. This option is priced by the insurance carrier to allow flexibility by design.

- Leveraging tax incentives, such as the ability to pay LTCi premiums pre-tax with your Health Savings Account (HSA) up to an annual limit,or paying through your business for tax deductibility along with tax-free benefits.

INSURANCE STRATEGIES TO CONSIDER

Buying minimum meaningful coverage of at least $100/day, a two-year benefit period, and 3% inflation.

Here are estimates of what the value of LTCi might be for a relatively healthy 40 year-old making $200,000 per year with projected LTCi benefits at age 80 compared to the Trust Act benefits.

EXAMPLE 1: MINIMUM MEANINGFUL COVERAGE; INDIVIDUAL AGE 40

*$100/day, two-year benefit period, 3% compound inflation, 90 day elimination period.

EXAMPLE 2: MORE ROBUST COVERAGE; COUPLE AGE 40

*$100/day, five-year benefit period, shared care rider (third pool), 3% compound inflation, 90 day elimination period.

It is worth noting that certain hybrid plans offering return of premium can also get significant insurance leverage. These plans typically require higher up-front costs to receive the best value plan designs. However, pre-paying LTCi policies that you’re planning to keep also has its perks. With a 10-pay, you have the ability to get a paid-up plan before retirement, guaranteed premiums on traditional policies, and the potential to front-load tax deductions.

IS THE PAYROLL TAX A GOOD DEAL?

The biggest limitation of the payroll tax is the lifetime maximum benefit of only $36,500 with limited growth potential.

- The likelihood of needing care at some point in your life may be greater than 50%.

- For an extended care need, the average length of claim for individuals that need care for at least 90 days may be about three years.

- The median cost of care in Washington state in 40 years may be close to $350,000 per year.

- This makes the average risk of long-term care costs in 40 years about $1,000,000 per person for those that have an extended need.3

Buying in the private LTCi market can allow families to take a much bigger amount of the risk off the table, so those who engage a specialist in an exercise of true LTC planning will have the most to gain prior to November 1.

One final suggestion: if you know you want to purchase LTCi, don’t wait. It is important to educate yourself about your options before making a decision. However, start planning early if you are considering purchasing private LTCi. There are a limited number of insurance products and LTCi specialist agents in Washington state. During normal times, it typically takes about 30-60 days to educate yourself, apply for, and get approved for coverage. Given the increased volume because of this new payroll tax, we anticipate wait times could significantly increase, and that puts at risk your ability to opt out of the tax.

Good luck in the planning process and let us know how we can be of assistance. Our LTCi specialist community is here to help. We are also vetting LTCi specialists from across the country to plug them into Washington State opportunities and leverage our platform. You can contact me (or your BGA) directly for more information. Long term care planning may be one of the most meaningful things you can do for your family to protect them from becoming unintended caregivers.

1 www.genworth.com/aging-and-you/finances/cost-of-care/ cost-of-care-trends-and-insights.html

2 app.leg.wa.gov/rcw/default.aspx?cite=48.83.020

3 www.genworth.com/aging-and-you/finances/cost-of-care.html

For more information on the Washington Trust Act, also known as the Washington Cares Fund, visit www.wacaresfund.wa.gov/about-the-wa-cares-fund/. For information on how to opt out, visit www.buddyins.com/wa-enroll

Share:

You Might Also Like

BuddyIns Monitors CA State LTC Payroll Tax Updates

CALABASAS, CA, UNITED STATES, January 4, 2023 /EINPresswire.com/ — On December 15, 2022, the California Long Term Care Insurance Task Force released the results of a Feasibility Report evaluating the viability of a state-funded long-term care insurance benefit and possible long-term care payroll tax to fund the benefit. In 2019, the California State Legislature passed AB 567, […]

Read More >