Updated February 19, 2024

As a wave of older Americans face the real possibility of needing long term care, the New York legislature is considering once again funding a modest amount of state-provided long-term care (LTC) coverage financed through a payroll tax on most workers in the state.

There are still many questions about details on the full legislation and administration should this bill be passed. However, the nation’s fourth most populous state has taken legislative steps to explore the possibility of offering a public long term care benefit.

New York State considered this possibility with draft legislation as recently as 2022, which did not pass the legislature. This 2023 bill is very similar to the 2022 legislation with an attempt to develop an LTC payroll tax, public benefit amount, and private long term care exemption with direct references to the Washington State LTC payroll tax.

Source: https://www.nysenate.gov/legislation/bills/2023/S8462

Key takeaways of the proposed legislation:

- LTC payroll tax similar to Washington State with a modest payroll tax yet undefined to make the program self-sustaining, but with references to the 0.58% of wages in the Washington LTC payroll tax.

- Provides for an exemption from the obligation to pay premiums and receive benefits for individuals who have maintained private long term care insurance on an uninterrupted basis beginning no later than January first of the year in which the act takes effect

- Private long term care insurance solutions that qualify for exemption are defined here: https://newyork.public.law/laws/n.y._insurance_law_section_1117

- This section refers to qualified long-term care insurance contracts as defined in section 7702B of the internal revenue code

- Other NY LTC payroll tax exemptions include individuals who maintain a permanent residence outside of the state of New York, U.S. military veteran with a service-connected disability of seventy percent or greater; a spouse or registered partner of an active duty service member; an employee with a non-immigrant visa for temporary workers

Other Legislation Details

- An individual must “earn” the benefit by working at least ten years during their lifetime

- Premium contributions collected similar to income tax withholding for employees and income tax payments by self-employed individuals

- Premium contributions set at the lowest amount necessary to maintain the program on sound financial footing

Important Benefit Information As Proposed

- NY LTC Trust program would provide universal long term care benefits at an initial rate of $100 per day for a lifetime limit of 365 days’ worth of benefits

- To qualify for benefits, the individual then must prove that they need assistance with at least two activities of daily living

START YOUR LONG TERM CARE PLAN NOW

We do not know yet whether there this NY LTC payroll tax bill will become law and when it will become effective. However, if you plan to purchase LTC insurance anyway now may be a good time to pursue meaningful LTC coverage for the following reasons:

- You never know when a long term care event might happen. Having a plan in place can provide near-term benefits for your family and protect your ability to get future coverage should a health event disqualify you, but not necessarily make you disabled

- Start the process of obtaining coverage is that planning early may result in the best value solution. If you begin planning when you are younger, you get a better overall value assuming your health is good. Waiting could mean that the premium costs are higher

- There may be fewer LTC insurance options in New York than in other states. As we discovered in Washington, when there is sudden demand, the supply of private insurance products may not adequately support all of the demand. In Washington, many carriers pulled out of the market, there were significant underwriting delays, and the carriers pulled some of their richest LTC features, and imposed minimum benefit requirements

A LIFE INSURANCE OR LONG-TERM CARE PRODUCT THAT FITS YOUR NEEDS AND BUDGET

At BuddyIns, we recommend obtaining meaningful coverage rather than just enough to possibly qualify for a state exemption. What does that mean for you? Meaningful coverage provides the insurance benefits that may best cover the risks you believe will impact you. The cost is affordable, and it is a plan that you can financially manage over your lifetime. The most popular solutions in Washington came from not only affordable LTCi-focused coverage but also life insurance coverage with LTC riders. Younger clients who did not have their life insurance plans used the WA payroll tax as an opportunity to protect their families with affordable hybrid policies.

The ideal candidate to purchase long-term care insurance or life insurance is someone who would have pursued coverage regardless of the any payroll tax. They may now decide to buy sooner than they would have because of proposed government programs and the ability to opt-out or supplement the state benefits.

Higher earners with more income and assets to protect may see the best value from purchasing a private plan. If a proposed payroll tax is a percentage of all wages, like in WA, a higher earner could pay more into the payroll tax than they could get in benefits.

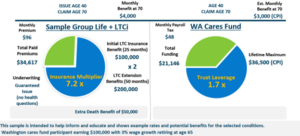

For example, a 40-year-old employee is making $200,000 per year and expects her wages to grow 3% per year. If she retires at age 65, she will have put in a projected $42,293 over 25 years. If the lifetime maximum is similar to the Washington State benefit, it will be around $36,500 with nominal increases.

However, one should never purchase a long term care insurance policy solely for the purpose of opting out of a proposed payroll tax. Reach out to a long-term care specialist if you would like to begin the planning process. Even if you are not ready to purchase yet, understanding your options and meeting with an LTCi specialist will allow you to act more quickly later.

>>Learn About Other States Considering a Long Term Care Payroll Tax

LONG-TERM CARE INSURANCE-FOCUSED SOLUTIONS

Traditional Long Term Care Insurance or Life Insurance Hybrids with LTC riders

The main types of 7702B or qualified long term care insurance products or riders:

- In NY, employers can offer their employees a guaranteed issue group life insurance product with a true LTC rider

- There are currently a few individual traditional LTC insurance products in the marketplace

- There are a few more individual life insurance products with LTC riders

The products that were most popular in Washington were group life with LTC riders. BuddyIns estimates that 65% of the policies purchased for exemption purposes were purchased through employers offering coverage to employees. The advantages of this approach were:

- Group Life + LTC has no underwriting requirements and can be enrolled very quickly with an enrollment firm that specializes in LTC insurance

- The premiums are amongst the most affordable of the different types especially for the ages where the employees were impacted the most between 18-55

- Benefits may be more limited as a starter plan than individual solutions such that there was a concern that the state might impose a minimum benefit level. This did not seem to happen in practice

Let’s look at some numbers by considering a 40-year-old NY employee. This employee decides she wants to purchase a group Life with LTC rider policy through her employer offering the plan as an employee benefit. She is considering what benefits would be paid should she need care at age 70. In this scenario, she could obtain a policy with about 4 years of protection to provide a total of $200,000 of tax-free LTC benefits. By adding these benefits, she maintains control over her care rather than leaving it to her family to decide on their own.

By using our BuddyIns proprietary software, Benefit Buddy, we created the chart below. It reflects the impact of purchasing long-term care insurance vs. the Washington LTC Payroll Tax (WA Cares Fund), which looks very similar to the proposed NY LTC payroll tax legislation.

The employer may also be able to fund a basic plan with as little as $50,000 of LTC benefits at a lower cost for all of their employees.

Group plans are not the only option when it comes to long-term care coverage. Individual traditional and hybrid life + long-term care insurance can provide even more comprehensive LTCi coverage, including:

- Higher pool of LTC benefits and monthly benefits

- Inflation riders that grow the benefits significantly over time

- Longer benefit durations of coverage

- Cash value flexibility for hybrids

Keep in mind that these plans are fully underwritten and may cost more for greater comprehensive coverage. So, take your time early to meet with a long-term care insurance specialist who can shop the market and get you coverage well before there is a rush due to impending legislation.

>>Your Guide to Long-Term Care Insurance

START NOW TO OPTIMIZE YOUR CHOICES REGARDLESS OF THE NEW YORK PAYROLL TAX

At BuddyIns, we do not recommend purchasing long term care insurance purely to qualify for a possible payroll tax exemption. A private long term care insurance policy can provide peace of mind to anyone interested in having more options in the event that they need extended care. It reduces the strain on other assets and the burden on the family. The great news is most working employees should be able to obtain coverage either through their employer or individually shopping the private market. Starting the process sooner rather than later can provide you with the most options and peace of mind. We highly recommend that you begin your process by speaking with a long-term care specialist.

Share:

You Might Also Like

Is Long Term Care Insurance a Good Deal?

In this video we take a look at whether long term care insurance is better than self funding long term care. We’ll compare the costs and benefits of both options and help you decide which is the best choice for you. Meet with a long term care insurance specialist to compare your options side by […]

Read More >Teachers Protect Their Life Savings

Renowned LTCi expert Scott Olson tells the story of two clients, both teachers, who were looking for a way to protect their special needs son and their assets.

Read More >Manage Cash Flow with No-Frills LTC Plan

With retirement and grandchildren on the horizon, and rental properties to manage; find out how one couple planned for their future and protected assets for their children.

Read More >