Long term care insurance can be a difficult sale. There are several reasons for that:

- The belief that it’s too expensive

- People think they won’t need it

- The mistaken belief that Medicaid will pay the bills

- Assuming that family will take care of them

- Believing they can self-fund their care

Whatever the reason, managing the objections is all about education and showing the value that insurance provides versus the cost. What is a client getting for the cost of that risk transfer and is it worth it to them? We call that the “value narrative.”

Storytelling and sales have always gone hand in hand. But how do we create a story that speaks to clients? With our exclusive Benefit Buddy tool, you can learn how to build engaging narratives demonstrating the potential value of long-term care insurance.

Keep it relevant

The foundation of a successful narrative is that it needs to be relevant to each client. They need to be able to see themselves benefiting from a solution. As you guide your client through the long term care planning process, you are paying close attention to their finances, health and medical history, and what their expectations are should they need extended care.

Many consumers today prefer more flexibility from their LTC insurance solutions. Some popular plans include:

- Hybrid products that are based on life insurance or annuities offer guaranteed premiums, cash value, and a return of premium if LTC is not needed

- Products that allow for the premium to be pre-paid at the time of purchase over a set number of years for predictable premiums

- Products that pay cash benefits at the time of claim for more flexibility instead of reimbursement benefits that require receipts

- Couple’s plans that provide discounts and allow flexibility in sharing benefits

So, you have a lot to work with when it comes to solutions.

Did you know that the average monthly price for a pay-as-you-go traditional LTC insurance policy is around $250 per month?

But cost is just one piece of the puzzle. The value narrative also brings into the discussion the price compared to the insurance benefits. How does it correspond to a client’s goal of covering the cost of care? What other additional benefits are provided by the insurance company?

Every client situation is unique; so if you’re offering generalized scenarios and stories, you’re wasting everyone’s time. With such a variety of LTCi solutions, Benefit Buddy can assist you in quickly determining which solutions are ideal for your client’s circumstances and requirements.

The value narrative is personal

You don’t have to be a creative genius: The narrative can be created through example scenarios with some basic information from the client.

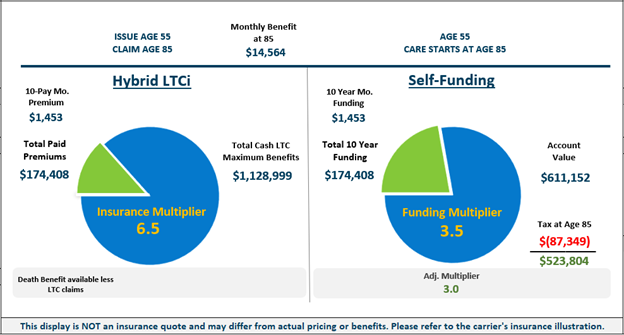

Below is one example created in Benefit Buddy for Jill, a single female, age 55, who is projected to need care at age 85. This client believed she could self-fund her long term care so the goal here was to show her what was possible if she chose some form of long term care insurance over self-funding.

For this example, Jill discloses some basic information including that she has no major health issues, she wants to limit her premium payments to ten years, and she would prefer a death benefit in the event that she never used the long term care benefits.

The value narrative we’ve created below with Benefit Buddy reflects:

- A 6.5 insurance multiplier versus a 3.5 self-funding multiplier

- That means Jill would receive $6.50 in benefit dollars for each premium dollar as opposed to $3.50 for each self-funding dollar invested

- Total long term care maximum benefits available to Jill at age 85:

- $1,128,999 insurance benefit vs $523,804 self-funding account value

Benefit Buddy Example

Insert the client in the story

You can see from the above example that we have personalized the value narrative for Jill. That focuses the story on her. Additionally, you can expand on this personal value narrative.

Personal Circumstances

Was there a personal situation for the client that led them to reach out to you? Were they personally impacted by a loved one’s need for care, visited an educational webinar, concerned about their financial assets? Typically, it’s the problem they were trying to solve or a goal they were hoping to accomplish. Remember to keep going back to that in your discussions.

Customized Strategy

What strategy can you create to address the client’s problem or help them meet their goals? What challenges can be overcome through an appropriate plan?

Creating customized narratives is an excellent way to connect with clients, build relationships, and make them feel more engaged in the planning process. Be sure that the value narrative applies to their individual situation and, whenever possible, that you draw upon experiences that they have already had with long term care.

To learn more about Benefit Buddy and how it can help you build a powerful value narrative for your clients click here.

Share:

You Might Also Like

LTCi: Show or Tell?

Wouldn’t it be nice to show your clients the value of long-term care insurance rather than just tell them? How do you present strategies and solutions to clients in a compelling way that moves them to take action? Join the BuddyIns team as they present new sales tools that can build a stronger and more […]

Read More >7702(b) or Not to Be: Why 7702(b) Matters for Long-Term Care Planning

Why 7702(b) Matters for Long-Term Care Planning Marc Glickman, CEO and Co-Founder, BuddyIns No, this is not a dissertation on Hamlet Act 3 Scene 1, although considering whether a product meets the IRC section 7702(b) guidelines can seem like it. Let’s set the scene and provide the backstory. Some states, like Washington, are considering […]

Read More >LTCi Market Updates Q1 2023

Q1 2023 We’re seeing a greater willingness to innovate when it comes to product development and a desire from some important carriers to improve technology and enrollment processes. Much more exciting news to come on that in Q2. Life Insurance + LTCi Hybrid Nationwide Hot off the presses! CareMatters II will be released in CA […]

Read More >